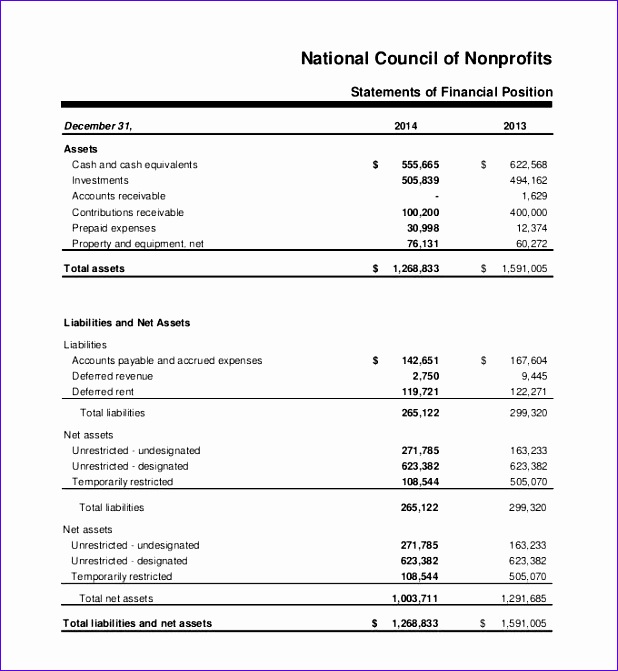

This includes investing in necessary overhead expenses such as technology, personnel, and other operational costs. This statement breaks down expenses by purpose—programs, management, and fundraising—providing insight into fund allocation. The above breakdown allows you to see exactly where your nonprofit has extra cash, and where your organization may be spending too much cash. When preparing your year-end impact reports, you can anticipate how your balance sheet may be perceived and incorporate that into the narrative.

- Fund accounting requires that organizations keep track of these funds and report them on their Statement of Financial Position.

- Another important aspect of the additional disclosures is the disclosure of potential risks and uncertainties.

- Nonprofit cash flow statements will refer to “change in net assets” instead of “net income,” and will sometimes list cash flows that are restricted to certain uses.

- So you can see which assets you can use to offset your liabilities, if and when it’s necessary.

- Net assets, also known as equity or fund balance, represent the organization’s total assets minus its liabilities.

Nonprofit Financial Reporting and Tax-Exempt Status

These statements play a crucial role in promoting transparency, accountability, and informed decision-making in the nonprofit sector. A nonprofit balance sheet provides a snapshot of the organization’s financial position at a specific point in time. It outlines what the nonprofit owns (assets), what it owes (liabilities), and the resulting net worth (net assets).

Are You Ready To Outsource Your Accounting?

Financing activities refer to the activities that involve raising funds for the nonprofit organization. These activities include obtaining loans, issuing bonds, and receiving contributions from donors. The funds raised through financing activities are used to support the organization’s operations and how to pass journal entries for purchases accounting education programs. It is important for nonprofit organizations to carefully manage their financing activities to ensure financial stability and sustainability. By effectively managing financing activities, nonprofits can secure the necessary resources to fulfill their mission and serve their beneficiaries.

Example of Main Difference Between Nonprofit and For-Profit Balance Sheets

This section includes items such as accounts receivable, inventory, and property. The liabilities section includes items such as accounts payable, loans, and deferred revenue. The net assets section includes items such as unrestricted net assets, temporarily restricted net assets, and permanently restricted net assets. There are several insights that you can pull from your nonprofit statement of financial position. It provides information about the overall financial health of your nonprofit. That’s because it shows the amount of flexibility you have in your funding to pay for additional operating expenses necessary for growth.

Assessing Financial Health of a Nonprofit

Just like the statement of financial position, the statement of activities keeps net assets that have conditions and stipulations attached to them separate from unrestricted funds. The statement of activities (also sometimes called the operating statement) is like the nonprofit version of the income statement. Like the income statement, it tells you how “profitable” your NFP was over a given period by showing your revenue, minus your expenses and losses. By analyzing the balance sheet, stakeholders can determine the company’s liquidity, profitability, and solvency.

On your Form 990, the IRS requires you to report your financial information according to different rules than you use for your audited financial statements. Chances are you’ve looked at your organization’s profit and loss report and never thought much about the balance sheet. Another important aspect of the additional disclosures is the disclosure of potential risks and uncertainties. Nonprofit organizations face various risks and uncertainties that may impact their financial stability and ability to achieve their mission.

When you’re a Pro, you’re able to pick up tax filing, consultation, and bookkeeping jobs on our platform while maintaining your flexibility. At Taxfyle, we connect small businesses with licensed, experienced CPAs or EAs in the US. Finding an accountant to manage your bookkeeping and file taxes is a big decision. Take our 2-minute survey to find out if outsourced accounting and bookkeeping is a good fit for your organization.

Yes, most nonprofits must file some version of Form 990, based on their size. • Financing activities This includes earnings and expenses from financial activities, such as interest earned from savings or interest or fees paid on loans. • Investing activities This includes things like interest earned on investments, the purchase of long-term investments, and payments on long-term investments (such as buildings, land, or equipment). • Expenses This section reports all cash that flows out of your organization, including the cost of programs, fundraising, and overhead.