What Is Account Reconciliation?

Consequently, any transactions recorded in the bank statement and missing in the cash register should be added to the register. It is possible to have certain transactions that have been recorded as paid in the internal cash register but that do not appear as paid in the bank statement. An example of such a transaction is a check that has been issued but has yet to be cleared by the bank.

The Reconciliation Process

In this section, we look at some examples of accounts reconciliation to understand the scope of work involved in accounts reconciliation and the tools that can help ease the process. Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs. Regardless of where the figures get taken from, the goal would also be similar. And the end result is always to find a zero balance between the 2 sets of figures. It can reduce vendor queries and make control of spending much more efficient. In a general sense, it demonstrates that balancing the books gets taken seriously.

Bank reconciliation

Rectifying the bank errors bring the bank statement balance and the cash book balance into an agreement. As noted earlier, your state cash flow from financing activities may have specific requirements for how often you must conduct three-way reconciliation—such as monthly or quarterly. Businesses and companies need to conduct reconciliation to ensure the consistency and accuracy of financial accounts and records within the business. Because the individual is fastidious about keeping receipts, they call the credit card to dispute the amounts. After an investigation, the credit card is found to have been compromised by a criminal who was able to obtain the company’s information and charge the individual’s credit card.

It’s a critical tool for maintaining a healthy cash flow and preventing any missed payments from going unnoticed. With real-time reconciliation capabilities, HighRadius ensures that your financial records are updated daily. This is particularly helpful to organizations where a large number of transactions take place every day. Its powerful matching algorithms quickly identify and resolve variances, increasing speed and accuracy. For example, a company maintains a record of all the receipts for purchases made to make sure that the money incurred is going to the right avenues.

Bank reconciliation is an accounting process where you compare your bank statement with your own internal records to ensure that all transactions are accounted for, accurate, and in agreement. Reconciling the accounts is a particularly important activity for businesses and individuals because it is an opportunity to check for fraudulent activity and to prevent financial statement errors. Reconciliation is typically done at regular intervals, such as monthly or quarterly, as part of normal accounting procedures. Individuals should reconcile bank and credit card statements frequently to check for erroneous or fraudulent transactions. After 60 days, the Federal Trade Commission (FTC) notes, they will be liable for „All the money taken from your ATM/debit card account, and possibly more—for example, money in accounts linked to your debit account.“

After finding evidence for all differences between the bank statement and the cash book, the balances in both records should be equal. You should prepare a bank reconciliation statement that explains the difference between the company’s internal records and the bank account. Legal software for trust accounting can help you track transactions and reconcile records and bank statements. Clio’s legal trust management software, for example, allows you to manage your firm’s trust accounting, reconcile directly in Clio, and run built-in legal trust account reports. In general, reconciling bank statements can help you identify any unusual transactions that might be caused by fraud or accounting errors.

- Reconciliation ensures that accounting records are accurate, by detecting bookkeeping errors and fraudulent transactions.

- Such regular and timely reconciliations support financial integrity and informed decision-making.

- Any unexplained differences between the two records may be signs of financial misappropriation or theft.

- The errors should be added, subtracted, or modified on the bank statement balance to reflect the right amount.

What is the Account Reconciliation Process?

Account reconciliation comes in various forms, each tailored to address specific financial aspects and discrepancies within an organization. Understanding the different types is crucial for maintaining financial accuracy and transparency. Whether it’s reconciling bank statements, vendor accounts, or intercompany transactions, each type plays a pivotal role in ensuring that records are consistent and errors are promptly identified and corrected.

Account reconciliation is an important accounting process as the entries in the general ledger may not always be accurate. For instance, when you receive a check from a customer, you may have recorded it as paid. But there are chances that the check could have bounced due to numerous reasons. Reconciliation in accounting is needed whenever there are financial transactions to ensure accuracy and consistency in the records. It’s typically required at regular intervals, such as monthly, quarterly, or annually, to verify that internal records match external statements like bank accounts, supplier invoices, or customer payments.

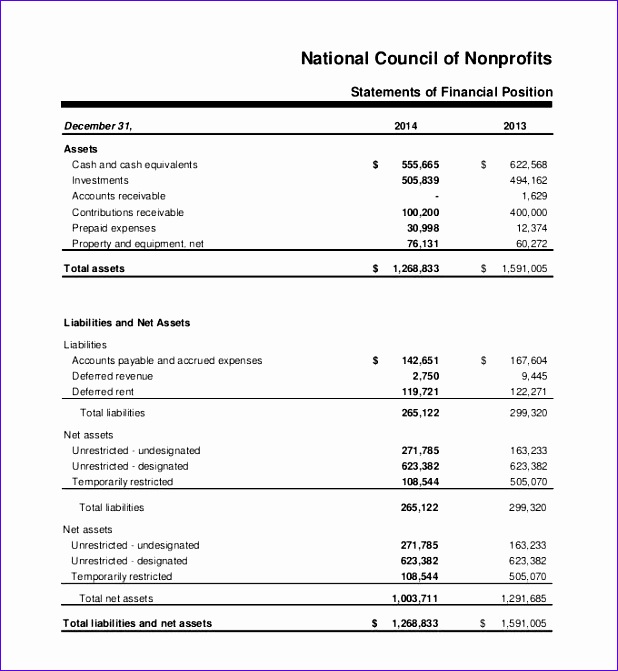

Understanding the Nonprofit Balance Sheet: A Comprehensive Guide to Statement of Financial Position

This includes investing in necessary overhead expenses such as technology, personnel, and other operational costs. This statement breaks down expenses by purpose—programs, management, and fundraising—providing insight into fund allocation. The above breakdown allows you to see exactly where your nonprofit has extra cash, and where your organization may be spending too much cash. When preparing your year-end impact reports, you can anticipate how your balance sheet may be perceived and incorporate that into the narrative.

- Fund accounting requires that organizations keep track of these funds and report them on their Statement of Financial Position.

- Another important aspect of the additional disclosures is the disclosure of potential risks and uncertainties.

- Nonprofit cash flow statements will refer to “change in net assets” instead of “net income,” and will sometimes list cash flows that are restricted to certain uses.

- So you can see which assets you can use to offset your liabilities, if and when it’s necessary.

- Net assets, also known as equity or fund balance, represent the organization’s total assets minus its liabilities.

Nonprofit Financial Reporting and Tax-Exempt Status

These statements play a crucial role in promoting transparency, accountability, and informed decision-making in the nonprofit sector. A nonprofit balance sheet provides a snapshot of the organization’s financial position at a specific point in time. It outlines what the nonprofit owns (assets), what it owes (liabilities), and the resulting net worth (net assets).

Are You Ready To Outsource Your Accounting?

Financing activities refer to the activities that involve raising funds for the nonprofit organization. These activities include obtaining loans, issuing bonds, and receiving contributions from donors. The funds raised through financing activities are used to support the organization’s operations and how to pass journal entries for purchases accounting education programs. It is important for nonprofit organizations to carefully manage their financing activities to ensure financial stability and sustainability. By effectively managing financing activities, nonprofits can secure the necessary resources to fulfill their mission and serve their beneficiaries.

Example of Main Difference Between Nonprofit and For-Profit Balance Sheets

This section includes items such as accounts receivable, inventory, and property. The liabilities section includes items such as accounts payable, loans, and deferred revenue. The net assets section includes items such as unrestricted net assets, temporarily restricted net assets, and permanently restricted net assets. There are several insights that you can pull from your nonprofit statement of financial position. It provides information about the overall financial health of your nonprofit. That’s because it shows the amount of flexibility you have in your funding to pay for additional operating expenses necessary for growth.

Assessing Financial Health of a Nonprofit

Just like the statement of financial position, the statement of activities keeps net assets that have conditions and stipulations attached to them separate from unrestricted funds. The statement of activities (also sometimes called the operating statement) is like the nonprofit version of the income statement. Like the income statement, it tells you how “profitable” your NFP was over a given period by showing your revenue, minus your expenses and losses. By analyzing the balance sheet, stakeholders can determine the company’s liquidity, profitability, and solvency.

On your Form 990, the IRS requires you to report your financial information according to different rules than you use for your audited financial statements. Chances are you’ve looked at your organization’s profit and loss report and never thought much about the balance sheet. Another important aspect of the additional disclosures is the disclosure of potential risks and uncertainties. Nonprofit organizations face various risks and uncertainties that may impact their financial stability and ability to achieve their mission.

When you’re a Pro, you’re able to pick up tax filing, consultation, and bookkeeping jobs on our platform while maintaining your flexibility. At Taxfyle, we connect small businesses with licensed, experienced CPAs or EAs in the US. Finding an accountant to manage your bookkeeping and file taxes is a big decision. Take our 2-minute survey to find out if outsourced accounting and bookkeeping is a good fit for your organization.

Yes, most nonprofits must file some version of Form 990, based on their size. • Financing activities This includes earnings and expenses from financial activities, such as interest earned from savings or interest or fees paid on loans. • Investing activities This includes things like interest earned on investments, the purchase of long-term investments, and payments on long-term investments (such as buildings, land, or equipment). • Expenses This section reports all cash that flows out of your organization, including the cost of programs, fundraising, and overhead.

Best Accounting Software For Small Business Of 2024

Accounting is popularly regarded as “the language of business” because it doesn’t just help you keep track of your money, but also helps you make informed decisions about your business. To speed up action, you may hire accounting professionals or purchase accounting software to ensure accurate financial audits and reporting. Companies with little or no inventory and few employees can use inexpensive or free basic accounting software.

A form would then appear on the same screen, enabling me to promptly add the required details, such as a service item for sale or a customer. This streamlined process allowed me to address all requirements directly from the invoice screen, providing clear guidance on what was needed to fully complete the task. All this to say, each step provided clear links or buttons to walk me through each subsequent step.

Best for document management

Sole proprietors don’t legally need a separate account, but it’s definitely recommended. Few small business owners are accounting experts, but to be successful, it helps to know a little about how to do accounting for a small business. Setting up a document management system can help with organizing 5 1 cost behavior vs cost estimation your records so that they’re easier to review. There are different ways to organize files, depending on what you need to store.

What Are the Benefits of Using Accounting Software for Small Businesses?

Small-business accounting is a set of financial activities for the processing, measurement, and communication of a business’s finances. These activities include taxes, management, payroll, acquisition, and inventory. When setting up accounting for startups, you need to choose vintage yellow accounting practice forms a method of recording financial transactions. There are basically two methods of recording income and expenses – the cash basis and the accrual basis of accounting.

Lizzette stays up to date on changes in the accounting industry through educational courses. Accountants calculate net income by subtracting a business’s expenses from its revenue. If revenue is lower than expenses, the business experiences a net loss. Gains include money made from one-time, non-business activities, like selling off old equipment or unused buildings. Income statements focus on four key items — revenue, gains, expenses, and losses — which bookkeepers use to calculate net income. Companies typically prepare balance sheets at the end of every quarter, but individuals can prepare them at any time.

This can be as simple as a statement showing your current cash position, expected upcoming cash receipts, and expected cash payments for this period. This what is payroll accounting content has been made available for informational purposes only. Learners are advised to conduct additional research to ensure that courses and other credentials pursued meet their personal, professional, and financial goals. Taxes and government compliance to certain rules and regulations may be best managed by a certified accountant professional (CPA). All employees must fill out an I-9 and W-4 form upon employment for tax purposes.

Manage cash flow.

- Intuit QuickBooks has a 4.3-star rating and a 4.4-star rating on Capterra and G2, respectively, with over 6,700 reviews on the two platforms.

- Most accounting software automates entering information from the documents above.

- Consider sending a reminder the day before an invoice is due or the moment it becomes past due.

- In addition, call-to-action buttons helped me know what I needed to do to customize the platform to my needs, such as adding a bank account or filtering reports.

Still, I could at least right-click on its listing in “unfiled” documents and move it to a folder of my choosing, allowing me to save it as an expense I could refer to later come tax time. This list was highly customizable, a theme I would experience while testing different features on the platform. For example, I could immediately use the search bar across the top of the screen to search my documents by keyword. And when I clicked “filter” at the top of the screen, a drop-down menu appeared that allowed me to filter the documents stored by date added, source, folder, keyword search, category or date.

However, they complain that it is not as easy to use on a Mac computer and the interface looks dated on these devices. When I tried testing this software on a Mac computer, I experienced one glitch after another with installation, making it impossible to even download the software and get it going. Users also say that they experience significant bugs with updates that sometimes leave necessary features unusable until the bug is resolved. By clicking “edit dashboard,” you can only remove a couple of reports but cannot add any new ones.

They also like that it has lots of reporting features and easy data backup capabilities. Once you’ve sent your invoice, you can then track invoices to ensure they’re paid, run reports that show the age of each outstanding invoice and apply invoice payments to specified transactions. I signed up for a free trial of FreshBooks’ accounting software and tested it on a Mac laptop using the Safari browser. All action items were clearly labeled and I was walked through how to complete all tasks.

Contribution Margin: Definition, Overview, and How To Calculate

In this chapter, we begin examining the relationship among sales volume, fixed costs, variable costs, and profit in decision-making. We will discuss how to use the concepts of fixed and variable costs and their relationship to profit to determine the sales needed to break even or to reach a desired profit. You will also learn how to plan for changes in selling price or costs, whether a single product, multiple products, or services are involved. Therefore, the unit contribution margin (selling price per unit minus variable costs per unit) is $3.05. The company’s contribution margin of $3.05 will cover fixed costs of $2.33, contributing $0.72 to profits.

Unit Contribution Margin

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

Ask Any Financial Question

In the United States, similar labor-saving processes have been developed, such as the ability to order groceries or fast food online and have it ready when the customer arrives. Do these labor-saving processes change the cost structure for the company? The first step to calculate the contribution margin is to determine the net sales of your business. Net sales refer to the total revenue your business generates as a result of selling its goods or services. Dobson Books Company sells textbook sets to primary and high schools.

Everything You Need To Master Financial Modeling

As a result, a high contribution margin would help you in covering the fixed costs of your business. To calculate contribution margin (CM) by product, calculate it for each product on a per-unit basis. After you’ve completed the unit contribution margin calculation, you can also determine the contribution margin by product in total dollars.

Weighted average contribution margin per unit equals the sum of contribution margins of all products divided by total units. Weighted average contribution margin ratio equals the sum of contribution margins of all products divided by total sales. As another step, you can compute the cash breakeven point using cash-based variable costs and fixed costs.

So, it is an important financial ratio to examine the effectiveness of your business operations. Sales revenue refers to the total income your business generates as a result of selling goods or services. Furthermore, sales revenue can be categorized into gross and net sales revenue. Furthermore, it also gives you an understanding of the amount of profit you can generate after covering your fixed cost.

Compare the lines for determining accrual basis breakeven and cash breakeven on a graph showing different volume levels. Gross margin is calculated before you deduct operating expenses shown in the income statement to reach operating income. Each profit measure can be expressed as total dollars or as a ratio that is a percentage of the total amount of revenue. The variable costs to produce the baseball include direct raw materials, direct labor, and other direct production costs that vary with volume. However, an ideal contribution margin analysis will cover both fixed and variable cost and help the business calculate the breakeven. A high margin means the profit portion remaining in the business is more.

- Management uses this metric to understand what price they are able to charge for a product without losing money as production increases and scale continues.

- The contribution margin is the leftover revenue after variable costs have been covered and it is used to contribute to fixed costs.

- If total fixed cost is $466,000, the selling price per unit is $8.00, and the variable cost per unit is $4.95, then the contribution margin per unit is $3.05.

- Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

- This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

The contribution margin represents how much revenue remains after all variable costs have been paid. It is the amount of income available for contributing to fixed costs and profit and is the foundation of a company’s break-even analysis. Total contribution margin (TCM) is calculated by subtracting total variable costs from total sales.

This, in turn, can help people make better decisions regarding product & service pricing, product lines, and sales commissions or bonuses. The concept of contribution margin is applicable at various levels of manufacturing, business segments, and products. Where C is the contribution margin, R is the total revenue, and V represents variable costs. While there are plenty of profitability metrics—ranging from the gross margin down to the net profit margin—the contribution margin metric stands out for the analysis of a specific product or service.

Additionally, it assists in setting pricing strategies to ensure that products are priced appropriately to cover both variable and fixed costs while maximizing overall profitability. Overall, the unit contribution margin provides valuable insights into the financial performance of individual products or units and helps guide strategic decision-making within organizations. As mentioned above, contribution margin refers to the difference between sales revenue and variable costs of producing goods or services.

The contribution margin represents the revenue that a company gains by selling each additional unit of a product or good. This is one of several metrics that companies and investors use to make data-driven decisions about their business. As with other figures, it is important to consider contribution margins in relation to other metrics rather than in isolation. Profit factoring software made powerfully simple try it today margin is calculated using all expenses that directly go into producing the product. The formula to calculate the contribution margin is equal to revenue minus variable costs. Alternatively, companies that rely on shipping and delivery companies that use driverless technology may be faced with an increase in transportation or shipping costs (variable costs).

Best Bookkeeping Software for Small Business 2023

Accordingly, the information provided should not be relied upon as a substitute for independent research. Intuit Inc. does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. The single-entry bookkeeping method is often preferred for sole proprietors, small startups, and companies with unfussy or minimal transaction activity. The single-entry system tracks cash sales and expenditures over a period of time.

An accounting firm has several key duties to its clients, especially when it comes to CAS. Accounting practice management software like Karbon should be at the core of yours. These tools are purpose-built to handle multiple clients across multiple verticals efficiently, with automated workflows, specialized client management tools, and AI features. Trying to manage payroll in-house is also risky for business owners because they are then responsible for employee data security. On the other hand, offering a variety of payment options and including links to pay on digital invoices makes it easy for customers to pay. First, if you bill by the hour, they ensure you get paid for your time and your employees’ time.

Bookkeeping vs. accounting

That should make collaboration easier for Xero-using small-business owners who (wisely!) work with financial advisors around tax time. And thousands of accountants and bookkeepers do use Xero already, so you can search Xero’s directory to find a local accountant who’s already familiar with the software. Online bookkeeping services might be the exact solution you need to save both time and money. The service you decide to use depends on the needs of your business and may include extra features such as payroll or tax documents. If you find that you have a talent for and enjoy the process, you may consider starting your own bookkeeping business providing this service to others.

By analyzing historical data and generating customized reports, businesses can identify areas for improvement, forecast future cash flow, and make data-driven decisions to optimize profitability. Advanced features like predictive analytics and artificial intelligence offer even deeper insights, enabling proactive financial management and strategic planning. Technology facilitates seamless integration between bookkeeping software and other business systems such as payroll, inventory management, and customer relationship management (CRM) software. Integrated systems ensure data consistency across different departments and eliminate the need for manual data entry, reducing the risk of errors and improving efficiency. For example, syncing sales data from a CRM system with bookkeeping software streamlines the invoicing process and improves cash flow management.

File-Sharing Solutions

If you choose its chief financial officer (CFO) services, your CFO will be a certified public accountant (CPA) at a minimum. Its features include automation of tasks, Gusto payroll processing, balance sheet production, income statements, accuracy checks and transaction databases. However, you can share most accounting solutions with an accountant or bookkeeper, including accounting software that otherwise limits its users by plan.

Accounting firms report strong revenue and profit, buoyed by CAS and value-based pricing – Accounting Today

Accounting firms report strong revenue and profit, buoyed by CAS and value-based pricing.

Posted: Fri, 17 Nov 2023 08:00:00 GMT [source]

QuickBooks Live is our top pick for online bookkeeping services because it offers cleanup bookkeeping services that vary based on your company’s needs for your first month. This service is ideal for business owners who want to get their bookkeeping in order but don’t have the time or resources to do it themselves. In the rapidly evolving world of finance and technology, staying informed about the top solutions on the market is crucial for businesses seeking to streamline their financial processes. This section highlights some of the leading bookkeeping solutions available, each offering unique features and benefits to cater to various business needs.

Financial Dashboard

You can generate interactive financial reports any time and send them to your key financial collaborators, including business partners or tax advisors. The primary purpose of bookkeeping is to record the financial effects of transactions. An important difference between a manual and an electronic accounting system is the former’s latency between the client bookkeeping solutions recording of a financial transaction and its posting in the relevant account. For example, if you handle tax accounting services, why not partner with a payroll service company? Or, if you offer wealth management services, it might be interesting to partner with an attorney who specializes in handling the legal aspects of wealth, such as wills.

When you share your expertise without asking for anything in return, it builds trust and convinces prospective clients without selling. To figure out which events you should be at, go back to your ideal customer profile. If your ideal customers are all small businesses, for example, find out what local events geared towards small businesses are coming up.

2 7: Nomenclature of Ionic, Covalent, and Acid Compounds Chemistry LibreTexts

We will start with binary ionic, which are between monatomic anions and cations. We note that there are two types of metals, those that have only 1 charge (Type 1), and those that can have more than one stable charge. Finally, polyatomic ions often form which are covalently bonded atoms where the total number of protons is not equal to the total number of electrons.

We will understand later this semester that as you go down a family or group of the periodic table, the volume of the atoms increases. The reason the second row nonmetals are an exception can best be understood by their small size (how are you going to get 4 oxygens around a small fluorine)? So on an exam at the freshmen level, I would probably treat them as if they follow the same trend as chlorine, because that is the schema you are learning. Some of the metals form very common ions which have latin names that are in common use, and you need to be familiar with those in the following table. Note, accounting profit definition „-ic“ stands for the higher oxidation state (charge), and „-ous“ stands for the lower oxidation state. We use the Principle of Charge Neutrality, that is, for an ionic compound to be stable its chemical formula MUST BE NEUTRAL.

Free Shipping

As we have seen in the previous section, there are two types of monatomic ions, those of elements that form only one charge state, and those that can form multiple charged states. The anions are all of the first type, and gain electrons until they have the same number as the nearest noble gas. But metals form cations by losing electrons, and some metals form only one stable cation, while others can form many.

Journal of Fluorine Chemistry

For simplicity, we will call metals that form only one (invariant) charge state to be Type I and those that form variable charge states to be type 2. It is probably easiest to identify the Type 1 and consider others to be Type 2. There are some transition metals that form only one stable ion. Silver (Group 1B) forms a +1 cation like the 1A alkali metals.

Design of high-entropy antiperovskite metal nitrides as highly efficient electrocatalysts for oxygen evolution reaction

This occurs because the number of oxygen atoms are increasing from hypochlorite to perchlorate, yet the overall charge of the polyatomic ion is still -1. To correctly specify how many oxygen atoms are in the ion, prefixes and suffixes are again used. We will start with ionic compounds, then covalent and then acids. So how can you do science if you do not know what you are talking about???

In this section we will look at nomenclature of simple chemical compounds. The rules we use depends on the type of compound we are attempting to name. Both are polyatomic ions, so you simply state the name of cation followed by the name of the anion. Barium is an alkaline earth and always corms a cation of charge of +2, while chlorine is a halogen and always form the chloride ion of -1. For barium chloride to be neutral you would need two chlorides for every barium, and so the formula is BaCl2. It is very important to include (aq) after the acids because the same compounds can be written in gas phase with hydrogen named first followed by the anion ending with –ide.

Clinical research has shown the natural ingredients in A2X can effectively help to relieve feelings of nervousness and anxiety and to promote relaxation, mood enhancement, and mental clarity. For best results, we recommend taking 1 to 2 capsules of A2X when you wake up in the morning so that the calming nutrients can work throughout the day. On days when feel you need a little extra assistance, taking an additional capsule in the evening can help keep you calm throughout the night and into the next morning. Every purchase of our 30 Day Supply comes with our 30 Day Money Back Guarantee. If you find that A2X is not for you, we don’t want you paying for it…

- Although HF can be named hydrogen fluoride, it is given a different name for emphasis that it is an acid.

- For best results, we recommend taking 1 to 2 capsules of A2X when you wake up in the morning so that the calming nutrients can work throughout the day.

- Earn free shipping when you order 2 or more bottles of A2X.

- So you do not need to state the number of cations and anions, you only need to state what they are (and what their charge is).

Just contact us and we will immediately arrange for a refund less shipping and handling. Clinical research has shown that each of the 3 natural herbs in the A2X formula help to boost levels of GABA and serotonin in the body. Strontium is a type I cation and there is no need for a Roman Numeral. Each of the ingredients in the A2X formula has a long-standing history of safety and effectiveness.